How I Cracked Early Retirement Without Gambling on Returns

What if you could retire years ahead of schedule without risking your life savings? I spent over a decade chasing high returns—only to realize stability matters more. After burning out and nearly losing everything, I shifted focus. Now, I’m sharing the real moves that helped me build predictable income, protect my capital, and gain true financial freedom. This isn’t about get-rich-quick schemes. It’s about smart, repeatable strategies that actually work. The journey wasn’t glamorous, but it was honest. It was built on discipline, not luck. And most importantly, it’s accessible to anyone willing to trade excitement for peace of mind and long-term security.

The Early Retirement Dream That Almost Broke Me

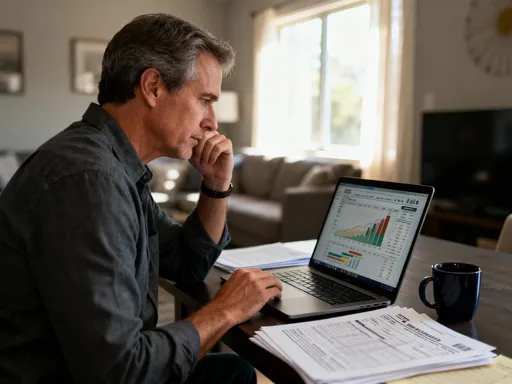

For years, I believed early retirement meant outsmarting the market. I studied charts, followed hot tips, and poured money into high-growth tech stocks and speculative ventures. My portfolio surged during bull markets, and I felt like a genius. But when the 2008 financial crisis hit, everything unraveled. Within months, I lost nearly 60% of my portfolio’s value. The stress was overwhelming. I couldn’t sleep. I argued with my spouse about money. I started taking antacids every night. The dream of retiring early suddenly felt like a reckless gamble—one I had lost.

That period changed me. I had equated success with returns, but I hadn’t considered what those returns cost me emotionally or how fragile they could be. I began to question the entire premise of aggressive investing. Was it really necessary to risk so much to achieve financial independence? I realized I wasn’t chasing freedom—I was chasing adrenaline. The real goal wasn’t to grow my money as fast as possible, but to grow it safely enough that I could live off it without fear.

I started reading about financial resilience, not just performance. I discovered investors who prioritized consistency over volatility and lived comfortably on modest but reliable returns. Their stories didn’t make headlines, but their results lasted. I began to shift my mindset from performance-driven to sustainability-driven. This wasn’t about giving up on growth; it was about redefining what growth meant. I wanted a portfolio that could weather storms, not one that collapsed under pressure. That shift in thinking became the foundation of my new financial life.

Why Return Stability Beats High Returns Every Time

It’s easy to be dazzled by stories of investors who doubled their money in a year. But those spikes are often followed by steep drops. What the market giveth, it can quickly taketh away. I learned that chasing high returns often leads to emotional decision-making. When your portfolio swings 30% in either direction, it’s hard to stay calm. Fear kicks in during downturns, and greed takes over during rallies. That emotional rollercoaster leads to selling low and buying high—the exact opposite of what you should do.

Stability, on the other hand, creates space for rational thinking. When your investments grow at a steady 5% to 7% annually, you’re not tempted to jump in and out of the market. You stay invested. You let compounding do its work. And over time, that consistent growth outperforms the volatile path. Consider this: a portfolio returning 8% annually with low volatility will grow more reliably than one averaging 10% with wild swings, because the drawdowns in the latter erode long-term gains. It’s not just about the math—it’s about behavior.

Studies in behavioral finance confirm this. Investors in high-volatility portfolios tend to underperform the very funds they own because they buy after prices rise and sell after they fall. The gap between fund returns and investor returns can be as wide as 4% per year. That’s a massive drag on wealth. By focusing on stability, you avoid that trap. You’re not trying to time the market—you’re building a system that works regardless of market noise. The goal isn’t to be the smartest investor in the room. It’s to be the most consistent.

Stable returns also make retirement planning predictable. If you know your portfolio earns 6% annually with minimal drawdowns, you can calculate how much you can safely withdraw each year. That certainty is priceless when you’re no longer earning a paycheck. High returns might sound better on paper, but stability gives you control. And control is what true financial freedom is built on.

Building a Foundation with Low-Volatility Assets

After my wake-up call, I rebuilt my portfolio from the ground up. I stopped chasing momentum and started focusing on resilience. My new foundation was built on low-volatility assets—investments that don’t swing wildly with market sentiment. These include dividend-paying blue-chip stocks, high-quality corporate and government bonds, and real estate investment trusts (REITs) with strong balance sheets. None of these are likely to double in a year, but they also don’t crash overnight.

I began by allocating 50% of my portfolio to bonds, primarily U.S. Treasury securities and investment-grade municipal bonds. These provide steady income and act as a buffer during stock market declines. When equities fall, bonds often hold their value or even rise, reducing overall portfolio volatility. I diversified across maturities to manage interest rate risk—some short-term, some intermediate. This way, I’m not locked into low rates for decades, nor am I overly exposed to rate hikes.

For the equity portion, I focused on large-cap companies with long histories of paying and increasing dividends. These are not trendy startups but established firms in sectors like consumer staples, healthcare, and utilities—industries that people rely on regardless of the economy. Companies like these tend to weather recessions better and provide income even when prices are flat. I also added exposure to international markets through low-cost index funds, ensuring I wasn’t overly dependent on the U.S. economy.

Real estate became another pillar. Instead of buying physical properties, I invested in REITs that own commercial, residential, and industrial properties. These funds distribute most of their income as dividends, providing another stream of cash flow. Because real estate often moves independently of stocks and bonds, it adds diversification. I made sure to choose REITs with low debt and strong occupancy rates to minimize risk. Over time, this diversified mix became my financial anchor—something I could count on, even when the market was chaotic.

The Income Engine: Designing Cash Flow You Can Count On

Retirement means no regular paycheck, so generating reliable income is essential. My goal was to create a cash flow stream that would cover my living expenses without requiring me to sell assets during downturns. I structured my portfolio so that dividends, interest, and rental income from REITs could meet my monthly needs. This way, I’m not dependent on market performance to pay the bills.

I calculated my annual expenses and built a withdrawal strategy around the 4% rule—a guideline suggesting you can withdraw 4% of your portfolio annually, adjusted for inflation, without running out of money over 30 years. But I didn’t blindly follow it. I made sure my portfolio could generate at least 4% in income from dividends and interest alone, so I wouldn’t have to sell shares unless absolutely necessary. This reduces sequence-of-returns risk—the danger of retiring just before a market crash and being forced to sell low.

To enhance reliability, I staggered my bond maturities, a strategy known as laddering. For example, instead of buying all 10-year bonds, I invested in bonds maturing each year from year one to year ten. As each bond matures, I reinvest the principal into a new 10-year bond. This smooths out interest rate fluctuations and ensures I always have cash available without selling in a down market. It also gives me flexibility to adjust as rates change.

I also prioritized dividend growth over high yield. A stock paying a 10% dividend might seem attractive, but if the company is struggling, that payout could be cut. Instead, I focused on companies with a history of raising dividends for 10, 20, or even 50 consecutive years. These ‘dividend aristocrats’ are more likely to maintain and grow their payouts, helping my income keep pace with inflation. Over time, this approach has allowed my cash flow to increase steadily, even as my withdrawals remain stable.

Risk Control: Protecting Your Nest Egg from Surprises

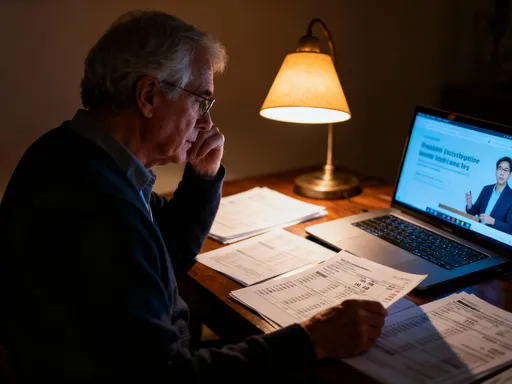

I used to think risk meant losing money in the stock market. But I’ve learned it’s broader than that. Risk includes inflation eroding purchasing power, interest rates rising, healthcare costs increasing, or living longer than expected. True risk management means preparing for these possibilities without letting fear paralyze you.

One of my key strategies is maintaining a cash reserve equal to two to three years of living expenses. This sits in high-yield savings accounts and short-term CDs. It acts as a shock absorber. If the market drops, I can cover my expenses from this reserve instead of selling depressed assets. This gives my portfolio time to recover. I replenish the cash bucket when markets rebound, ensuring it’s always ready for the next downturn.

I also avoid leverage. Borrowing to invest amplifies both gains and losses, and I’ve seen too many people lose everything this way. I own my investments outright. I don’t trade on margin, and I don’t use options to speculate. I do use options sparingly for hedging—like buying put options on broad market indexes during periods of high uncertainty. But this is a small part of my strategy, not a core component.

Regular portfolio reviews are another layer of protection. Every quarter, I assess my asset allocation. If stocks have risen significantly, I rebalance by selling some and buying bonds to maintain my target mix. This forces me to sell high and buy low—a disciplined approach that reduces emotional decision-making. I also run stress tests, imagining how my portfolio would perform in a 30% market drop or a period of high inflation. Knowing I can withstand those scenarios gives me peace of mind.

Behavioral Discipline: The Hidden Key to Long-Term Success

The biggest threat to financial success isn’t market risk—it’s human behavior. I’ve made every mistake: panic selling in 2008, chasing cryptocurrency in 2017, buying high after a stock’s big run. Each time, emotion overruled logic. What I’ve learned is that investing is more about psychology than math. The best strategy in the world fails if you can’t stick to it.

To combat this, I created a written investment policy statement. It outlines my goals, risk tolerance, asset allocation, and withdrawal rules. When emotions run high, I refer back to this document. It’s my anchor. I also automate as much as possible—dividend reinvestments, contributions, and even rebalancing through certain brokerage tools. Automation removes the temptation to interfere.

I no longer check my portfolio daily. In fact, I limit myself to quarterly reviews. Constant monitoring leads to overreaction. I’ve trained myself to think in years, not days. I remind myself that markets go up over time, and short-term noise doesn’t change that. I also avoid financial media that stokes fear or excitement. I read books and research, not headlines.

Building habits has been crucial. I treat investing like brushing my teeth—routine, not dramatic. I don’t need to make bold moves to succeed. I just need to stay consistent. Over time, this discipline has become second nature. I don’t feel the urge to chase the next big thing. I’m content knowing my system is working, even if it’s not flashy. That mental shift has been more valuable than any single investment decision.

Putting It All Together: My Real-World Early Retirement Blueprint

Today, I live off my portfolio without touching the principal. My system is simple: a diversified mix of low-volatility assets generates steady income, which covers my expenses. I withdraw only what the portfolio produces, and I let the rest compound. My allocation is roughly 50% bonds, 40% equities (mostly dividend growers), and 10% REITs. I review everything quarterly, rebalance when needed, and adjust only for major life changes.

My withdrawal strategy is conservative. I take out 3.5% annually, slightly below the traditional 4% rule, giving me a margin of safety. I take withdrawals monthly from my cash reserve, which I replenish from dividends and maturing bonds. This smooths out timing and avoids forced sales. If the market is down, I don’t increase withdrawals. If it’s up, I don’t splurge. I stay consistent.

The beauty of this system is its predictability. I know what to expect. I’m not waiting for a windfall or hoping for a market surge. I’ve built a machine that works quietly in the background. It doesn’t make me rich overnight, but it gives me freedom—freedom from financial stress, from job dependence, from the need to chase returns.

Early retirement isn’t about luxury or extravagance. For me, it’s about peace. It’s waking up without anxiety about money. It’s spending time with family, pursuing hobbies, and living on my own terms. This wasn’t achieved through genius or luck. It was achieved through patience, discipline, and a commitment to stability over spectacle. Anyone can do it—not by gambling, but by building wisely, protecting carefully, and staying the course. The real secret isn’t hidden in complex formulas or secret strategies. It’s in the quiet power of consistency.