Why Inheriting Wealth Feels Riskier Than You Think

Inheriting assets isn’t just about receiving money—it’s stepping into a high-stakes financial reality. I’ve seen families lose fortunes not from poor returns, but from emotional decisions and blind spots. Market shifts, tax traps, and family dynamics turn inheritance into a minefield. This isn’t just about growth—it’s about survival. Let’s break down how smart allocation can protect wealth, not just grow it. For many, an inheritance feels like a windfall, a reward for patience or a long wait. But behind the figures lies a complex web of responsibilities, expectations, and silent risks. The true challenge isn’t managing the money—it’s managing yourself, your family, and the system that governs wealth. Without preparation, even a substantial inheritance can dwindle within a decade. The goal here is not speculation or chasing quick gains. It’s about building a foundation that lasts—through discipline, clarity, and informed choices.

The Hidden Pressure of Inherited Wealth

Receiving an inheritance often arrives with a mix of relief, grief, and confusion. For many, especially women between 30 and 55 who may be managing households, caring for aging parents, or supporting children, the arrival of wealth can feel both empowering and overwhelming. The emotional weight is real. This money is rarely seen as purely financial—it carries memory, legacy, and sometimes guilt. Did I earn this? Should I share it? What would my parent have wanted? These questions don’t come with instruction manuals, yet they shape how the money is used.

One of the most common mistakes heirs make is treating inherited wealth as disposable income. Because it wasn’t earned through daily labor, there’s a psychological tendency to view it as “free money.” That mindset leads to lifestyle inflation—buying a larger home, upgrading cars, or funding extravagant trips—without considering long-term sustainability. Research shows that nearly 70% of wealth is lost by the second generation, and 90% by the third. The root cause isn’t bad investments; it’s behavior. The shift from being a saver to a steward of capital requires a complete reframe of identity and responsibility.

This transition also alters one’s relationship with risk. Many heirs, especially those unfamiliar with investing, either become too cautious—parking everything in low-yield savings—or too aggressive—jumping into speculative ventures out of a desire to “grow” the money quickly. Both extremes stem from insecurity. The former fears loss above all; the latter fears not measuring up. The key is not to eliminate emotion but to acknowledge it and build systems that prevent it from driving decisions. This starts with recognizing that inheritance is not a finish line—it’s the beginning of a new financial chapter that demands patience, education, and structure.

Market Realities No One Warns You About

When an inheritance arrives during a strong market, it’s easy to feel confident. Stocks are rising, real estate values are climbing, and the portfolio looks healthy. But markets are indifferent to personal circumstances. They don’t pause for grief, learning curves, or family meetings. The timing of an inheritance is often outside one’s control, and receiving it at a market peak can create a false sense of security. Historically, many heirs have made critical errors in the first 12 to 24 months after receiving assets—exactly when they are least prepared to handle volatility.

Consider the 2000 dot-com crash or the 2008 financial crisis. Heirs who inherited just before these events and held concentrated positions in equities saw dramatic declines. Those who panicked and sold at the bottom locked in losses. Others, believing the downturn was temporary, doubled down without understanding the underlying risks. The lesson isn’t that markets are dangerous—it’s that timing and positioning matter more than intuition. Economic cycles are inevitable, and inflation quietly erodes purchasing power over time. A portfolio that grows 6% annually but faces 3% inflation only delivers 3% in real gains. Over decades, that difference shapes outcomes more than any single investment decision.

Sector-specific risks also play a role. Many inheritances are tied to a single company—perhaps a family business or a long-held stock position. If that company faces disruption, regulatory changes, or declining demand, the entire portfolio suffers. This concentration is not a strategy; it’s a vulnerability. The market doesn’t reward loyalty—it rewards diversification. Understanding that past performance is not predictive of future results is essential. A stock that doubled in the last five years may stagnate or decline in the next. The goal isn’t to predict the market but to prepare for all possible outcomes through balanced exposure and realistic expectations.

Why Asset Allocation Isn’t Just for the Rich

Asset allocation is often misunderstood as a sophisticated tool for the ultra-wealthy, but it’s one of the most powerful strategies available to anyone managing inherited wealth. At its core, allocation is about spreading risk across different types of investments—stocks, bonds, real estate, cash, and alternative assets—so that no single event can devastate the entire portfolio. It’s not about maximizing returns in good times; it’s about surviving the bad ones. Studies consistently show that over 90% of investment returns are determined by asset allocation, not stock-picking or market timing.

Yet, many heirs keep too much of their inheritance in the same assets they received. A father’s life savings in company stock, a mother’s home, or a family farm become emotional anchors. Selling feels like betrayal. But financial health requires objectivity. Holding 60% or more of a portfolio in a single stock or property is not investing—it’s gambling. If that asset declines, the entire financial foundation shakes. Diversification isn’t about abandoning legacy; it’s about protecting it. By reallocating a portion of concentrated holdings into a mix of asset classes, heirs reduce exposure to any one risk while maintaining long-term growth potential.

A balanced approach might include a mix of domestic and international equities for growth, high-quality bonds for stability, real estate for inflation protection, and cash for liquidity. The exact mix depends on individual goals, time horizon, and risk tolerance. For a 45-year-old woman managing an inheritance while raising children, the strategy might emphasize moderate growth with capital preservation. For someone closer to retirement, income generation and lower volatility may take priority. The point is not to chase trends but to build a structure that aligns with life circumstances. Rebalancing annually—selling assets that have grown too large and buying those that have fallen—keeps the portfolio on track without requiring constant attention.

The Tax Trap Lurking in Every Portfolio

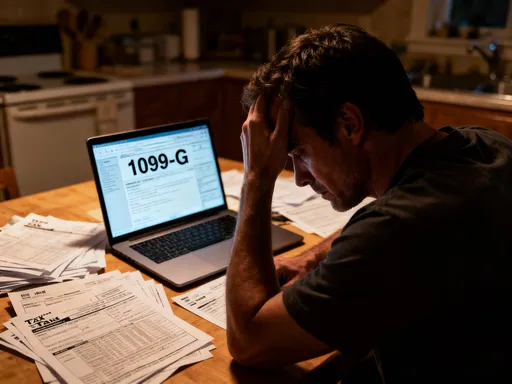

Taxes are one of the most predictable yet overlooked threats to inherited wealth. Unlike market swings, tax consequences can be planned for—but only if addressed early. Many heirs focus on the headline number: the value of the account or property. But what matters more is the after-tax value. Capital gains taxes, estate taxes, and required minimum distributions (RMDs) can quietly erode wealth over time, especially if no tax-efficient strategy is in place.

For example, inheriting traditional retirement accounts like IRAs or 401(k)s comes with RMDs. These are mandatory withdrawals that begin within a few years of inheritance and increase with age. Each withdrawal is taxed as ordinary income, potentially pushing the heir into a higher tax bracket. Without planning, this can create a cycle of forced selling and tax liability, especially if the heir doesn’t need the money. In contrast, Roth accounts offer tax-free growth and no RMDs during the owner’s lifetime, making them more flexible for long-term planning. Understanding the tax character of each asset is the first step in minimizing unnecessary losses.

Another common pitfall is the cost basis. In most jurisdictions, inherited assets receive a “step-up” in basis, meaning the heir’s cost basis is the value at the time of death, not the original purchase price. This can eliminate decades of unrealized capital gains. But if the heir sells shortly after and the asset has appreciated, they’ll owe taxes on that new gain. Holding periods, tax-loss harvesting, and gifting strategies can all play a role in reducing liability. Trusts, when used appropriately, can also provide control, privacy, and tax advantages. The key is not to avoid taxes—that’s impossible—but to structure holdings so that taxes don’t dictate financial decisions. Working with a tax professional early can prevent costly mistakes and preserve more wealth for the future.

Protecting Wealth From Family Friction

Money has a way of exposing tensions that were once manageable. Inheritance can strain even the closest families. Siblings may disagree on how to divide assets, especially if one was more involved in caregiving or if the will seems uneven. Adult children may pressure a surviving parent to spend or share wealth. Without clear communication, these conflicts can escalate into legal battles, forced sales, or broken relationships. The emotional cost often outweighs the financial one.

One of the most effective ways to prevent conflict is transparency. If multiple heirs are involved, holding a family meeting—ideally with a neutral advisor present—can set expectations early. Discussing the purpose of the wealth, the values behind the inheritance, and any wishes expressed by the deceased can foster unity. It’s also important to distinguish between equal and fair. Equal means everyone gets the same amount. Fair considers contributions, needs, and circumstances. A surviving spouse may need more liquidity, while a child with special needs may require a trust. These decisions should be made with care, not guilt.

Legal structures like trusts, joint accounts with rights of survivorship, and clear beneficiary designations help reduce ambiguity. Naming a professional fiduciary—such as a bank trust department or independent advisor—can also prevent family members from being put in difficult positions. Emotions run high during transitions, and having an impartial party manage distributions or investments can protect both the wealth and the relationships. Ultimately, the goal isn’t to avoid all disagreement but to create processes that allow for respectful resolution. Wealth preserved in isolation is a hollow victory; wealth preserved within healthy family dynamics is true success.

Building a Long-Term Game Plan (Without Losing Sleep)

Preserving inherited wealth doesn’t require genius—just consistency. The most successful stewards of family money aren’t those who make bold bets or time the market. They are the ones who follow a clear, written plan. This is called an investment policy statement (IPS), and it serves as a roadmap for decision-making. It outlines goals, risk tolerance, asset allocation, rebalancing rules, and the role of advisors. When emotions run high—during market drops or family disputes—the IPS acts as an anchor.

Start by defining the purpose of the wealth. Is it to fund education? Support retirement? Create a charitable legacy? Each goal has a different time horizon and risk profile. A college fund for young children may prioritize growth, while retirement income needs stability. Once goals are clear, set risk parameters. How much volatility can you tolerate before making an impulsive decision? For many, a 20% portfolio decline is the breaking point. Knowing this in advance allows for a portfolio structure that matches psychological comfort, not just financial theory.

Choosing the right advisor is equally important. Look for a fiduciary—a professional legally required to act in your best interest. Fee-only advisors, who earn compensation through flat fees or percentages of assets, often have fewer conflicts than commission-based brokers. They can help implement the IPS, monitor performance, and provide objective guidance during turbulent times. Regular reviews—quarterly or annually—keep the plan on track without requiring constant attention. The goal isn’t perfection; it’s progress. Small, consistent actions compound over time, just like investments.

Turning Inheritance Into Legacy

True wealth isn’t measured in account statements—it’s measured in impact. An inheritance becomes a legacy when it’s managed with purpose. This means more than avoiding losses; it means aligning money with values. For many women in midlife, this includes funding children’s education, supporting community organizations, or ensuring financial independence for future generations. These goals require more than returns—they require intentionality.

Legacy building starts with humility. No one inherits perfect knowledge. Ongoing learning—through books, workshops, or conversations with advisors—builds confidence and competence. Teaching the next generation about money, even in simple ways, ensures the wealth isn’t lost to ignorance. Trusts with educational incentives, matching funds for savings, or family meetings about values can instill responsibility without pressure.

Finally, legacy is about balance. It’s possible to enjoy the benefits of an inheritance—travel, home improvements, or time with family—while still preserving the principal. The goal isn’t austerity; it’s sustainability. By focusing on disciplined allocation, tax efficiency, and emotional resilience, inherited wealth can become a source of security, freedom, and meaning for decades to come. The greatest risk isn’t losing the money—it’s never truly owning it in the first place.