Why Timing Changed Everything in My Debt Payoff Journey

Paying off debt felt impossible—until I realized it wasn’t just about how much I paid, but when. I tried budgeting, side hustles, even drastic cuts, but nothing stuck. Then I shifted my focus to timing: syncing payments with income cycles, tackling high-pressure debts first, and using windfalls strategically. The results shocked me. This is the real story of how timing became my most powerful tool, not willpower or extreme sacrifice. What I discovered wasn’t taught in personal finance books or budgeting apps. It wasn’t about earning more or denying myself every small pleasure. It was about alignment—between money, mindset, and moments. And once I understood that, everything changed.

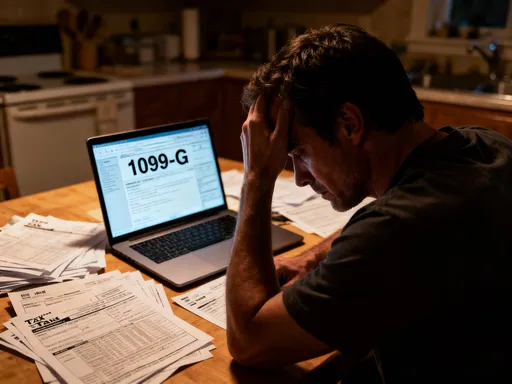

The Moment I Knew My Approach Was Broken

For years, I believed that paying off debt was a test of discipline. I thought if I just worked harder, spent less, and tracked every expense, I would eventually break free. I created spreadsheets, highlighted due dates, and even set phone alerts. I skipped coffee runs, canceled subscriptions, and picked up extra shifts. Yet, at the end of each month, my balances barely budged. The numbers on my statements seemed to mock me, moving at a snail’s pace despite my efforts. I felt trapped in a cycle of paying, stressing, and repeating—always reacting, never getting ahead.

What I didn’t realize at the time was that my approach wasn’t failing because I lacked willpower. It was failing because it ignored a fundamental truth: timing matters. I was making payments when they were due, not when my cash flow could support them. My payday was on the 15th and 30th of each month, but most of my bills were due between the 5th and 10th. That meant I was stretching money too thin in the first week of the month, leaving little room for debt payments. By the time my next paycheck arrived, I was already behind, relying on credit to cover gaps. I wasn’t managing debt—I was surviving it.

The turning point came when I stepped back and mapped out my entire financial rhythm. I printed a calendar and marked every income deposit, every bill due date, and every debt payment. What emerged was a clear pattern of imbalance. I had cash surpluses right after payday, but those were quickly drained by obligations due early in the month. Meanwhile, my credit card and personal loan payments landed in the worst possible window—when my account was at its lowest. I wasn’t overspending; I was mis-timing. Once I saw this, I knew the solution wasn’t more sacrifice. It was smarter sequencing.

This realization shifted my mindset completely. I stopped seeing debt repayment as a moral failing and started treating it like a logistical challenge. Just like cooking a meal requires ingredients to be added at the right time, managing debt required financial actions to be timed correctly. I wasn’t lazy. I wasn’t irresponsible. I was simply out of sync. And once I realigned, progress began to accelerate in ways I hadn’t thought possible.

How Income Timing Affects Debt Repayment

One of the most overlooked aspects of personal finance is the relationship between income timing and debt repayment. Most people are paid on a fixed schedule—biweekly or monthly—but their financial obligations rarely align neatly with that rhythm. This misalignment creates cash flow gaps, which in turn lead to stress, late fees, and reliance on credit. I experienced this firsthand. My salary arrived twice a month, but my rent, insurance, and utilities were due within the first ten days. That left the second half of the month with more breathing room financially, but also with less urgency to pay down debt. My debt payments, scheduled mid-month, often landed when my account was already depleted.

Once I recognized this pattern, I took action. I contacted my lenders and service providers to see if I could adjust due dates. Some were flexible. I moved my credit card payment to the day after my payday, ensuring that funds were available. For loans that couldn’t be rescheduled, I began setting aside the payment amount immediately after each deposit. This “pay yourself first” approach guaranteed that debt repayment wasn’t an afterthought. It became the first expense, not the last.

I also experimented with splitting payments. Instead of making one large monthly payment toward my credit card, I divided it into four smaller weekly transfers. This had two benefits. First, it reduced the psychological weight of each payment, making the process feel more manageable. Second, because credit card interest is calculated daily, reducing the balance more frequently led to lower overall interest charges. Over time, this small change saved me hundreds of dollars.

The impact of aligning payments with income cycles was immediate. I stopped overdrawing my account. I avoided late fees. Most importantly, I stopped feeling like I was constantly chasing my finances. Instead of reacting to due dates, I was in control. I had created a rhythm that worked with my reality, not against it. This wasn’t about earning more money—it was about using the money I already had more effectively. And that shift in timing made all the difference.

The Hidden Power of Psychological Momentum

When I first started my debt payoff journey, I followed the traditional advice: focus on the highest interest rate first. It made logical sense. Mathematically, it was the most efficient path. But emotionally, it was draining. My largest debt was a student loan with a moderate interest rate, but it would take years to pay off. No matter how much I paid, the balance barely moved. I felt like I was running on a treadmill—exerting effort but going nowhere. I was losing motivation, and I knew I needed a change.

Then I tried a different approach. I looked at my smallest balance—a $300 medical bill that had been lingering for months. I redirected extra funds to pay it off in full. The moment that zero appeared on my statement, something shifted. I felt a surge of accomplishment. It was a small win, but it mattered. For the first time, I saw tangible progress. That victory gave me the confidence to keep going. I realized that timing isn’t just about financial efficiency—it’s also about emotional timing. The right win at the right moment can reignite commitment.

I began prioritizing debts that could be eliminated quickly, even if they weren’t the most expensive. This strategy, often called the debt snowball method, isn’t always the most mathematically optimal, but it’s incredibly effective for building momentum. Each paid-off account became a milestone, a reminder that I was making progress. I started tracking my wins in a journal, celebrating each zero balance. This psychological reinforcement made the long-term journey feel sustainable.

What I learned is that motivation isn’t constant. It ebbs and flows. And timing your efforts to coincide with moments of emotional strength can make a big difference. By creating early wins, I built a foundation of confidence that carried me through tougher months. I wasn’t just paying off debt—I was building belief in myself. And that belief became one of my most valuable assets.

Using Windfalls the Right Way—And at the Right Time

Windfalls—unexpected sources of extra money like tax refunds, bonuses, or cash gifts—can be powerful tools in debt repayment. But only if used at the right time and with clear intention. I used to treat windfalls like bonus income to be spent freely. I’d receive a tax refund and tell myself I’d put “some” toward debt. But without a plan, that “some” often turned into new clothes, a dinner out, or home repairs. The money disappeared, and my debt stayed the same.

Then I changed my approach. I decided that any windfall would be split: 70% to debt, 20% to savings, and 10% to discretionary spending. But more importantly, I committed to acting quickly. I learned that the longer I waited to allocate the money, the more likely it was to be absorbed into daily spending. The key wasn’t just the amount—it was the timing of the decision.

Now, as soon as a windfall hits my account, I transfer the designated portions immediately. I don’t wait for “the right time” or “when I’m ready.” I act within 24 to 48 hours. This creates a sense of urgency and prevents second-guessing. I also notify my lender right away, ensuring the payment is applied promptly. The impact of an early windfall payment can be significant. For example, applying a $1,500 tax refund to a credit card with 18% interest can save over $400 in interest over five years, assuming no new charges. But if I delay that payment by even a month, the benefit shrinks.

Timing also matters in terms of financial seasonality. I used to receive my tax refund in March, when winter expenses were still high. Now, I adjust my withholding to get a smaller refund and keep more money throughout the year. This allows me to make consistent payments rather than relying on a single annual event. When I do receive a windfall, I treat it as a strategic opportunity, not a windfall to be frittered away. The right timing turns unexpected money into lasting progress.

Why Payment Frequency Matters More Than You Think

Most debt repayment plans are built around monthly cycles. Bills are due once a month. Statements arrive once a month. And so, we naturally think in monthly terms. But I discovered that shifting to a more frequent payment schedule had a surprising impact. Instead of waiting for the due date, I began making weekly or biweekly transfers toward my debts. This small change altered my entire relationship with repayment.

First, it improved cash flow management. By treating debt like a regular expense—similar to groceries or gas—I integrated it into my spending rhythm. Each time I got paid, I allocated a portion to debt immediately. This prevented the “last-minute scramble” that used to leave me stressed and short. Second, more frequent payments reduced the psychological burden. A $400 monthly payment felt heavy. But four $100 payments felt manageable. The total was the same, but the experience was different.

From a financial standpoint, increased payment frequency can lead to faster balance reduction, especially for credit cards. Since interest is calculated daily, lowering the balance more often reduces the average daily balance, which in turn lowers the interest charged. Over time, this compounds. For example, someone with a $5,000 balance at 19% interest who switches from monthly to biweekly payments could save over $200 in interest over two years and pay off the debt several months sooner.

But beyond the numbers, the real benefit was consistency. Frequent payments kept me engaged. I wasn’t just checking a box once a month—I was actively managing my debt every week. This created a sense of ownership and control. I wasn’t waiting for a statement to tell me what to do. I was taking initiative. And that shift in mindset made the entire process feel less like a chore and more like progress in motion.

Avoiding the Trap of Poorly Timed Financial Decisions

One of the most costly mistakes I made was consolidating my debt during a moment of financial stress. I was overwhelmed, behind on payments, and receiving collection calls. In that state of panic, I signed up for a consolidation loan with a longer term and a higher effective rate than I later realized. At the time, it felt like a relief—a way to stop the bleeding. But in hindsight, it was a decision made under pressure, not clarity.

I learned that timing applies not just to payments, but to major financial decisions. Acting in crisis mode often leads to suboptimal outcomes. When emotions run high, we prioritize short-term relief over long-term benefit. I now wait for calm moments to evaluate options. I give myself a 48-hour rule: no major financial decision without waiting two days. This simple pause allows me to research, compare, and consult without urgency clouding my judgment.

I also pay attention to external timing. For example, I avoid making debt decisions at the end of the month when funds are low. Instead, I schedule financial reviews right after payday, when I have a clear picture of my resources. I also time credit applications carefully, knowing that multiple inquiries in a short period can hurt my score. Strategic timing means choosing when to act, not just what to do.

This shift has saved me from costly mistakes. I once considered a balance transfer offer with a 0% introductory rate, but I waited and discovered hidden fees and a steep rate jump after the promotional period. By delaying the decision, I found a better option. Timing isn’t about procrastination—it’s about patience. And patience, I’ve learned, is one of the most powerful financial tools I possess.

Building a Sustainable System That Works Long-Term

Debt payoff isn’t a one-time event. It’s a process that requires consistency, adaptability, and long-term thinking. Once I understood the role of timing, I focused on building a system that could sustain me over time. I automated my key payments, ensuring they were made right after each payday. I set up calendar reminders for financial check-ins, so I could review progress and adjust as needed. I also built in flexibility—allowing for life changes, unexpected expenses, and occasional setbacks.

One of the most important elements of my system is tracking. I review my debt balances monthly, not daily. This prevents obsession and keeps me focused on trends rather than fluctuations. I celebrate milestones, like paying off a card or reaching a 50% reduction. These moments of recognition reinforce progress and keep me motivated.

I also protect my system from emotional interference. I don’t make impulsive payments out of guilt or urgency. I stick to the plan, even when it feels slow. I remind myself that consistency beats intensity. A small, well-timed payment every week is more effective than a large, reactive one once a year.

Most importantly, I’ve learned to be kind to myself. There were months when I had to reduce payments due to car repairs or medical bills. Instead of seeing those as failures, I view them as part of a realistic journey. My system isn’t about perfection—it’s about persistence. And by focusing on timing, I’ve turned debt repayment from a source of shame into a source of strength.

Debt freedom didn’t come from earning more or cutting everything out—it came from timing. Aligning payments with cash flow, seizing the right moments for action, and respecting emotional cycles made all the difference. It’s not just about the numbers; it’s about rhythm. When you master the timing, the path out of debt becomes clearer, calmer, and more achievable. I didn’t need more willpower. I needed better timing. And once I found it, everything changed.