How I Stopped Chasing Quick Wins and Built Real Financial Freedom Instead

For years, I thought financial freedom meant hitting a magic number in my bank account—then waking up rich. I jumped from one “get-rich-quick” idea to another, only to end up stressed and stuck. I tried day trading, followed viral stock tips, invested in speculative schemes promoted by influencers, and even considered risky leveraged loans—all in search of that elusive financial breakthrough. But each time, the excitement faded fast, replaced by anxiety and shrinking balances. It wasn’t until I shifted my focus from short-term gains to long-term return improvement that everything changed. This is the real journey—no hype, no false promises—just what actually worked when I stopped gambling and started building. The path to lasting financial security isn’t found in overnight windfalls, but in consistent, intelligent decisions made over time.

The Myth of Fast Money and the Wake-Up Call

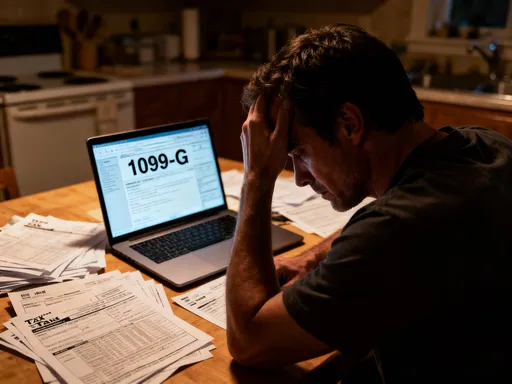

Like many people, I was drawn to the allure of fast money. The idea that I could turn a small investment into a life-changing sum in weeks or even days felt thrilling—almost too good to ignore. I began watching financial videos promising 10x returns, joined online communities where members celebrated sudden gains, and convinced myself that with enough effort and the right strategy, I could beat the system. I poured thousands into penny stocks, cryptocurrency swings, and unproven startups, often without doing proper research. Each decision was fueled by hope, not logic. And each time, the outcome was the same: short-lived excitement followed by steep losses.

The emotional toll was just as damaging as the financial hit. I started checking my portfolio obsessively, feeling my heart race every time the market dipped. I lost sleep. I argued with family about money. I felt trapped in a cycle of chasing the next big opportunity to recover what I had lost. The truth was, I wasn’t investing—I was speculating. And speculation, no matter how clever it seems, is not a path to financial freedom. It’s a high-stakes gamble where the odds are almost always against the individual. My wake-up call came after a particularly painful loss in a so-called “sure thing” crypto project that collapsed overnight. I realized then that I had been chasing illusions, not building wealth.

What I didn’t understand at the time was that real wealth isn’t created through sudden spikes, but through sustained, compounding growth. The obsession with immediate returns blinded me to the importance of consistency, patience, and risk management. I had ignored the fundamentals—diversification, cost control, long-term planning—in favor of excitement and the promise of quick rewards. The shift began when I stopped asking, “How much can I make this month?” and started asking, “How can I protect and grow my money over the next decade?” That change in perspective marked the beginning of a more thoughtful, disciplined approach to personal finance—one rooted not in emotion, but in strategy.

Redefining Financial Freedom: It’s Not About the Number

Most people define financial freedom as reaching a specific dollar amount—$1 million, $2 million, or more. They imagine quitting their jobs, moving to a tropical island, and never worrying about money again. While that image is appealing, it’s often misleading. I once believed that too. I thought that once I hit a certain net worth, all my problems would vanish. But after years of chasing that number and still feeling anxious, I realized something profound: financial freedom isn’t about the balance in your account. It’s about control. It’s the ability to make life choices based on what you want, not what you can afford.

True financial freedom means having enough stability to say no to things that don’t align with your values—whether that’s a job you hate, an expensive lifestyle you don’t enjoy, or financial pressure from others. It means being able to handle emergencies without panic, to support your family without stress, and to pursue meaningful goals without constant money worries. When I reframed freedom this way, my entire approach to money changed. Instead of obsessing over net worth, I focused on building systems that provided security, flexibility, and peace of mind. That shift in mindset was more powerful than any investment strategy I had ever tried.

This redefinition also helped me set more realistic and meaningful goals. Rather than aiming for a vague “retire early” dream, I began breaking down what financial independence would actually look like in my life. How much income would I need to cover essentials? What would it take to handle healthcare, housing, and family needs? How could I structure my finances so that I wasn’t dependent on a single source of income? These questions led me to prioritize steady return improvement over time, rather than chasing volatile gains. I began to see that long-term financial health comes not from hitting a number, but from cultivating habits, discipline, and resilience that allow you to thrive regardless of market conditions.

Return Improvement: The Quiet Engine of Wealth

If there’s one principle that transformed my financial life, it’s this: real wealth is built through return improvement, not through chasing the highest possible yield. Early on, I believed that to get ahead, I needed to find investments with the biggest returns—10%, 20%, even 50% annually. But I failed to realize that high returns often come with high risk, high fees, or both. What I didn’t lose to market downturns, I lost to hidden costs and poor timing. The breakthrough came when I stopped focusing on maximum returns and started focusing on consistent, sustainable improvement.

Return improvement isn’t about dramatic wins. It’s about making small, smart adjustments that compound over time. Think of it like upgrading from a leaky bucket to a sealed one. If you’re losing 2% a year in unnecessary fees, improving your returns by just 1% through lower-cost index funds or better asset allocation isn’t flashy—but it’s powerful. Over 20 years, that single change could add tens of thousands of dollars to your portfolio. Similarly, reducing emotional trading, avoiding panic selling, and staying invested through market cycles all contribute to better long-term outcomes, even if they don’t feel exciting in the moment.

The real power lies in compounding. When you reinvest gains and protect your capital, even modest annual improvements can generate exponential growth. For example, a portfolio earning 6% per year will double in about 12 years. One earning 8% will double in just 9 years. That 2% difference may seem small, but over decades, it can mean hundreds of thousands of extra dollars. The key is consistency. Instead of jumping from one “hot” investment to another, I focused on building a balanced, low-cost portfolio that aligned with my risk tolerance and time horizon. I prioritized efficiency—cutting fees, minimizing taxes, and reducing turnover—because I learned that preserving capital is just as important as growing it.

Risk Control: Protecting Your Gains Like a Pro

You can’t improve returns if you’re constantly losing money. That simple truth took me years to understand. Early in my journey, I viewed risk as something to conquer or avoid entirely. I either took reckless bets in pursuit of high rewards or avoided investing altogether during uncertain times. Both extremes hurt my progress. The smarter approach, I learned, is not to eliminate risk, but to manage it intelligently. Risk control is the foundation of any durable financial plan. Without it, even the best return-improvement strategies can unravel in a single bad year.

One of the biggest risks I faced was emotional decision-making. During market downturns, fear would take over. I’d sell low, convinced the recovery would never come. Then, when prices rose again, I’d buy high, chasing the momentum. This pattern—buying high and selling low—was the exact opposite of sound investing. It eroded my returns and made recovery harder. To break this cycle, I established clear rules: I would never make investment decisions based on headlines or emotions. I set predetermined rebalancing schedules and stuck to them, regardless of market noise. Over time, this discipline helped me stay the course and avoid costly mistakes.

Another major risk was overconcentration. At one point, I had over 60% of my portfolio in a single tech stock because I believed in the company and its growth potential. When the sector corrected, my net worth dropped sharply. That experience taught me the importance of diversification—not just across stocks and bonds, but across sectors, geographies, and asset classes. I also learned to avoid leverage. Borrowing money to invest might amplify gains, but it also magnifies losses. After seeing how quickly leveraged positions can collapse, I made a rule to never invest with borrowed funds.

Equally important was building an emergency fund. Without one, any unexpected expense—a car repair, medical bill, or job loss—could force me to sell investments at the worst possible time. I now keep six to twelve months of living expenses in a liquid, low-risk account. This buffer gives me the flexibility to make thoughtful decisions, not desperate ones. Risk control isn’t about playing it safe—it’s about playing smart. It’s about ensuring that you’re prepared for uncertainty so that short-term volatility doesn’t derail your long-term goals.

Practical Moves That Actually Move the Needle

Not all financial actions are created equal. Some make a real difference; others are just noise. Over the years, I’ve tried countless strategies—some complex, some trendy—but only a few consistently improved my returns. These weren’t flashy or complicated. They were simple, repeatable habits that, when done consistently, had an outsized impact. The most powerful changes weren’t about finding the next hot stock or timing the market. They were about doing the basics well and sticking with them.

One of the most effective moves I made was automating my investments. Instead of trying to time the market or decide when to buy, I set up automatic transfers to my retirement and brokerage accounts every payday. This ensured that I invested regularly, regardless of market conditions. Over time, this strategy allowed me to benefit from dollar-cost averaging—buying more shares when prices are low and fewer when they’re high. It removed emotion from the process and created consistency. I didn’t need to be perfect; I just needed to show up.

Another game-changer was cutting hidden fees. I once reviewed my investment accounts and discovered I was paying over 1% annually in management fees—money that was quietly eroding my returns. By switching to low-cost index funds and ETFs, I reduced my fees to less than 0.2%. That 0.8% difference may seem small, but over 20 years, it could save me tens of thousands of dollars. I also refinanced high-interest debt, negotiated lower insurance premiums, and reviewed subscription services I no longer used. These small savings added up, freeing up more money to invest.

Rebalancing my portfolio annually was another high-impact habit. Without rebalancing, my asset allocation would drift over time—equities might grow to 80% of my portfolio during a bull market, exposing me to more risk than I intended. By selling a portion of winners and reinvesting in underweight areas, I maintained my target mix and kept risk in check. Finally, I learned the value of staying the course. During market downturns, I didn’t panic. I reminded myself of my long-term goals and continued investing. History shows that markets recover, and those who stay invested tend to come out ahead. These practical steps didn’t make headlines, but they built real wealth.

The Role of Mindset in Long-Term Success

Your mindset is your most powerful financial tool—and your biggest obstacle. I’ve made sound financial decisions when I was calm and clear-headed, and terrible ones when I was anxious or impatient. Over time, I realized that building wealth isn’t just about numbers. It’s about psychology. Patience, discipline, and emotional resilience matter more than any single investment choice. The ability to delay gratification, ignore short-term noise, and stay focused on long-term goals is what separates successful investors from those who chase quick wins.

One of the hardest mental shifts was accepting that growth is slow. In a world of instant results, waiting decades for compounding to work feels unnatural. I had to retrain myself to celebrate small wins—like sticking to my budget for a month, avoiding an impulse purchase, or completing a quarterly portfolio review. I stopped comparing my progress to others, especially those who appeared to be getting rich fast online. Social media distorts reality; for every viral success story, there are thousands of quiet failures. I focused instead on my own journey, measuring success by consistency, not speed.

Fear of missing out—FOMO—was another major hurdle. When everyone was talking about a new investment trend, I felt pressure to jump in. But I learned to pause and ask: Does this align with my goals? Do I understand the risks? Can I afford to lose this money? If the answer was no, I walked away. That discipline protected me from several bubbles and scams. I also learned to embrace boredom. The most effective financial strategies aren’t exciting. They’re routine. They’re uneventful. And that’s exactly why they work. By training my mind to value stability over spectacle, I made better decisions and built lasting wealth.

Building a System That Works While You Live Your Life

Financial freedom isn’t about micromanaging your money every day. It’s about creating a system that works for you, even when you’re not actively thinking about it. Early on, I believed I needed to constantly monitor the markets, adjust my portfolio, and hunt for new opportunities. That approach was exhausting—and counterproductive. The real breakthrough came when I designed a low-maintenance financial system that prioritized sustainability over intensity.

I automated everything I could: contributions to retirement accounts, bill payments, savings transfers. I chose reliable, low-cost investment vehicles—broad-market index funds and target-date funds—that required minimal oversight. I set up a simple review rhythm: quarterly check-ins to assess performance, rebalance if needed, and adjust contributions. This structure gave me confidence without consuming my time. I wasn’t chasing perfection; I was building resilience.

The result? I gained freedom long before I reached any magic number. I could focus on my family, my health, and my passions without constant money stress. I no longer felt the need to check my portfolio daily or react to every market fluctuation. My system was designed to grow steadily, protect gains, and adapt over time. Financial freedom, I realized, isn’t a destination you arrive at after decades of sacrifice. It’s a byproduct of living intentionally, making wise choices, and building systems that support your life—not control it.

The journey from chasing quick wins to building real financial freedom wasn’t easy, but it was worth it. It required letting go of fantasies, confronting mistakes, and embracing patience. But the reward is more than money. It’s peace of mind. It’s confidence. It’s the ability to live on your own terms. You don’t need a miracle or a windfall. You need a plan, discipline, and the courage to stay the course. When you stop gambling and start building—intentionally, steadily, and wisely—real financial freedom begins.